Just Posted

Brand New Content

Fresh Content

Just Posted on the Site

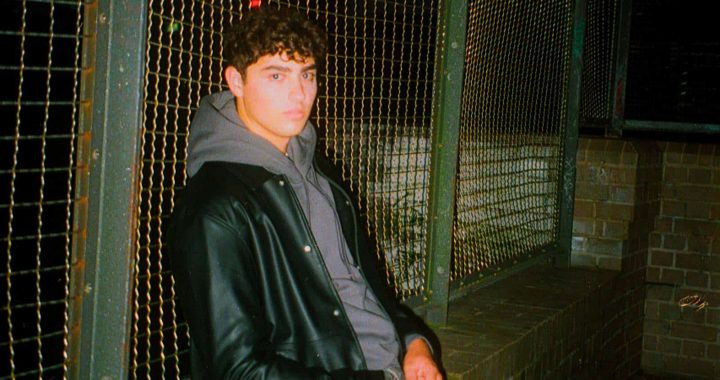

Rising Talents

The up-and-coming stars that should be on your radar

International Pop

The Best Music From Outside the US and UK

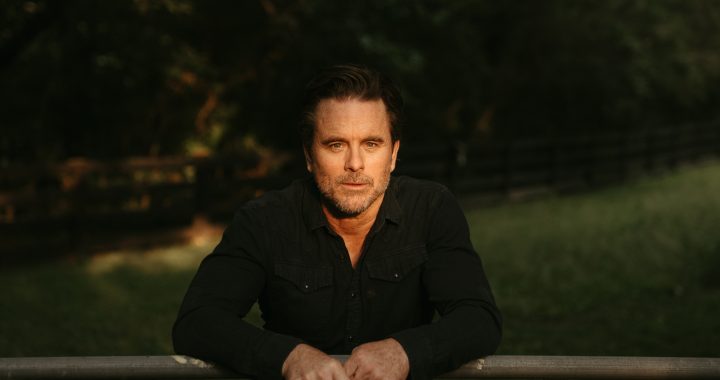

Interviews

Get to Know New and Established Talent

Eurovision

Douze Points Goes To...

Film Reviews, Trailers, News and Features

"All right, Mr. DeMille, I'm ready for my close-up."

THEATRE

Life Is a Cabaret